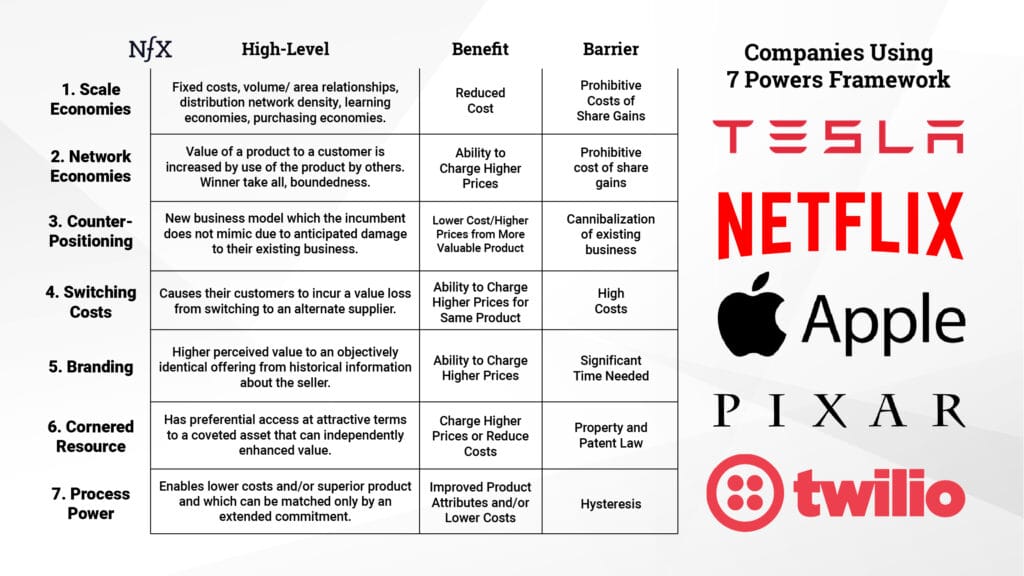

What do Tesla, Apple, Netflix and Pixar have in common? They all apply a little-known concept called “7 Forces,” developed by author, strategist and Stanford professor Hamilton Helmer. By doing so, they create the conditions for sustainable returns and make the company defensible. This also shows that current performance is not an indicator of future success.

What is the 7 forces strategy?

The 7 Forces is a practical theory of strategy based on the concept of “power,” i.e., the conditions that create the potential for sustained return differentials. Invention always comes first. Every company faces a “do-or-die” strategy: a critical directional decision. The 7 Forces are a real-time strategy compass.

Who developed the 7 forces strategy?

At Helmer & Associates (later Deep Strategy), a strategy consulting firm he founded, Hamilton Helmer has led over 200 strategy projects with major clients including Adobe Systems, Hewlett-Packard, Netflix, and Spotify. Over the past two decades, he has also applied his strategy concepts as an active equity investor and is currently chief investment officer and co-founder of Strategy Capital.

He holds a doctorate in economics from Yale University. Hamilton currently teaches business strategy at Stanford University andis the author of 7 Powers: The Foundations of Business Strategy.

1. Network Effects

The value of a service to each user increases as new users join the network (company, service, product). There is a force called the network economy, but there are 6 other powers, and large companies can have any number of them. In fact, several of them can work together.

Let’s take Uber as an example. The company has created a versatile platform that is revolutionizing personal transportation. There are network effects here, but the problem is that more than one company can benefit. Lyft can also take advantage of this incredible value and compete with Uber in this market.

Network effects are a key driver of product-market fit in this case. Product-market fit is a measure of how well the product and its value proposition satisfies the market, and therefore the customer segment and their needs. So it is the target and end customer that decides if the product satisfies them and if the Product-Market-Fit is given or not.

You can create tremendous value for your customers, but you also have to be able to keep some of it for yourself. If that’s not the case, it becomes a company that’s just not fun to run.

In the case of Uber, you can think about what keeps a competitor in check, which is scale density in certain geographic areas.

However, the larger the area, the smaller the advantage Uber has over a company like Lyft. In large markets, you can easily have two competitors.

They can compete against each other, and that will be the basis of their competition. They will both benefit from network economies, so this is not really a source of strength.

Question: How can your company benefit from network effects and what are they?

2. Cornered Resource

A company that takes advantage of a contested resource has preferential access to a coveted asset on attractive terms that can independently increase value.

If you have rights to certain resources or assets that can’t be taken away from you, that’s a cornered resource. They are materially valuable, so if they were transferred to another company, that company would also reap the economic benefits.

Let’s take Pixar as an example. In the early days of Pixar, there was a group that went through the hell of developing Toy Story 1 and 2 and learned to collaborate in incredibly creative ways. Everyone who was involved was put in a position to make these amazing films. And Pixar landed an incredible hit series that is unparalleled in the film industry.

Since then, Pixar has been a sought-after resource made up of the talent needed to make these digital films. The whole group is the resource that matters.

Disney tried to poach some of them, but they wouldn’t leave. Eventually, Disney bought out Pixar. They were a valuable resource that made the company successful.

The first group of directors was their limited resource. And for Pixar to be a great company in the future, they need to expand that pool of directors.

Question: What is the limited and contested resource for your company?

3. Scale Economies

Economies of scale occur when there is an economic relationship in which unit costs decrease as volume increases. This means that the market leader has an advantage.

So if you’re bigger, you have a lower cost position, which means you make more money at the same prices.

Let’s take Netflix as an example. Netflix went through an incredible transformation when it had a fierce battle with Blockbuster for the red envelope business. It wasn’t enough, because they knew that physical delivery as a technology would eventually die out. They knew it would eventually be replaced by streaming, so they had to get into the streaming business.

The problem with the streaming business, though, is that if you’re just a distribution channel, anyone can do it. The technology is not that hard.

You did the Epix deal, which cost about a billion dollars. What happened in that was that they suddenly got exclusive rights to content, and that brings economies of scale, because exclusive rights are a fixed cost.

If you think about a single production, think about the series House of Cards, which they produced for $100 million. Netflix’s cost of content per viewer went down with scale.

Question: What economies of scale can you create for your company?

4. Switching cost

The consistency of the product can protect one from the forces of competition if it retains customers.

Take SAP as a classic example of switching costs. Enterprise software like SAP is not only expensive and time-consuming to implement, but it also typically requires customized workflows and training for employees.

Once vendors lock in customers, the likelihood that they will switch to an alternative is very low, even if another product is better.

Question: How can you increase switching costs for your customers?

5. Counter Positioning

This is Hamilton’s favorite of the 7 forces. A newcomer introduces a new, superior business model that the incumbent will not imitate for fear of damaging its existing business. This is a little different than the classic innovator’s dilemma.

When a company develops a new business model based on software, and the incumbents are not software companies, becoming a software company often means that they have to change their business a lot. They need different people, different compensation structures, and a different organization.

Let’s look at Apple with the iPhone versus Nokia. Nokia had a finely tuned supply chain, the product development cycle was masterful. But then Apple came along with a product that was essentially software-driven, which presented Nokia with the existential dilemma of either accepting someone else’s software or trying to do it themselves, which they couldn’t. They would have had to change their entire existing business.

The counter-positioning often comes in the form of economic impact, because that’s what really keeps companies from adapting quickly.

Twilio’s pricing model is that you sign up for Twilio and spend the first cent to send a text message, make a call, have a video session or chat.

In this building block system, you only pay for what you use. In an industry that’s all about selling licenses for software, or telecom companies a two-year contract for a line.

If you’re a developer building a new service, you don’t want to sign a two-year contract. You want to spend as little as possible because the more barriers and friction you remove, the more ideas can be implemented.

I think it’s very hard for companies that are used to selling seats, licenses or two-year contracts and line access to change. It’s very hard for them to imagine a business where they sell something for a fraction of a cent because they’re like, “How can I incentivize my sales team? I have a big sales team.”

So there’s this entry point where people don’t know what to make of it. They can’t imagine how this can even be a business.

They certainly don’t know how to implement it, and they don’t have the will to implement it. That gives you a head start of many years to create value before someone wakes up and says, “Oh wow, there is something to this. Maybe we should seriously think about this.”

Question: How does your company achieve counter-positioning?

6. Branding

There is a real difference between branding as a force and brand awareness. Not that brand awareness isn’t important, but you can buy an ad for the Super Bowl and get brand awareness. You paid for it.

But branding is something that’s much more permanent than that. It’s about creating an understanding in the customer that they place a higher value on the product, even though the competing product may be objectively identical.

It takes a long time for people to become comfortable with something to build that perception so they will pay more.

This may be due to the expectation of additional quality or simply because people feel good about it and like being seen with it.

Some people are willing to pay $50,000 for an Hermès handbag.

Over time, they have developed this understanding of their customers. They trust them more or just want to be seen with it.

Let’s take Apple as an example. The result was a very long process in which Steve Jobs put aesthetics first. He didn’t just talk about it, he actually built aesthetics into the corporate culture.

Question: How can you improve the branding of your company or product?

7. Process Power

Embedded business organization and activity areas that enable lower cost and/or better product.

Process power is another force. The example here is Toyota and lean manufacturing. If you have an incredibly complicated business process, think about automotive production, all the supply chains, and production itself.

Over time, you gradually do a little bit of this and a little bit of that, and it becomes embedded in the way you do things in the company. Often it’s what’s called tacit knowledge.

It turns out that a competitor who wants to do this has a very hard time. It could be because it’s too complex, there are so many little things they have to do, or the opacity of it, that nobody really knows exactly what’s going on.

The time it takes to do this is so high that you end up gaining a large market share, like Toyota, and being very profitable.

There are legions of consultants who teach people best practices. But it’s usually something that can be replicated over time.

Question: How do you increase process performance in your company?

Summary of questions for the 7 powers

- How can your company benefit from network effects and what are they?

- What is the limited and contested resource for your company?

- What economies of scale can you create for your business?

- How can you increase switching costs for your customers?

- In what ways can your company achieve counter-positioning?

- How can you improve the branding of your company or product?

- How do you increase process performance in your company?

More information

More info and other great articles can be found at NFX.com

NFX Podcast: The 7 Powers with Hamilton Helmer & Jeff Lawson

Podcast Invest Like the Best Hamilton Helmer – Power + Business

Graphic header/title page : Joincolossus.com